2024 Tax Rates

As is the case with every municipality in the Province of Ontario, assessments are based on the prior years’ market value and are levied against the property owner. Property taxes are determined by multiplying the tax rate by the assessed value of the property provided for by the Municipal Property Assessment Corporation (MPAC). The tax rate is determined after Municipal Council approves the budget, which includes the total annual capital and operating requirements it needs to raise from taxes. The 2024 Tax Rates for the Township of Assiginack are as follows:

| CLASS | MUNICIPAL RATE | EDUCATION RATE | TOTAL RATE |

| Residential | 0.01546739 | 0.00153000 | 0.01699739 |

| Multi-Residential | 0.01546739 | 0.00153000 | 0.01699739 |

| Commercial Occupied | 0.01469402 | 0.00842583 | 0.02311985 |

| Commercial Vacant | 0.01028581 | 0.00842583 | 0.01871164 |

| Industrial Occupied | 0.01190989 | 0.00676308 | 0.01867297 |

| Industrial Vacant | 0.00774143 | 0.00676308 | 0.01450451 |

| Pipelines | 0.01734668 | 0.00000000 | 0.01734668 |

| Landfill | 0.01469402 | 0.00980000 | 0.02449402 |

| Farm | 0.00386685 | 0.00038250 | 0.00424935 |

| Managed Forest | 0.00386685 | 0.00038250 | 0.00424935 |

Tax Due Dates

There are four (4) tax due dates during a calendar year. The interim tax bill is mailed out mid February of each year and has two installments that are due in March and June.The Interim Tax Bill is formulated using the current year assessment and the previous year’s tax rate. The final tax bill is mailed in July of each year and is due in two installments in August and October. The final tax bill is calculated using the current year property assessment and municipal tax rate less the interim billing. If you have any further questions regarding your tax bill, please contact the Tax and Utility Manager at fbond@assiginack.ca

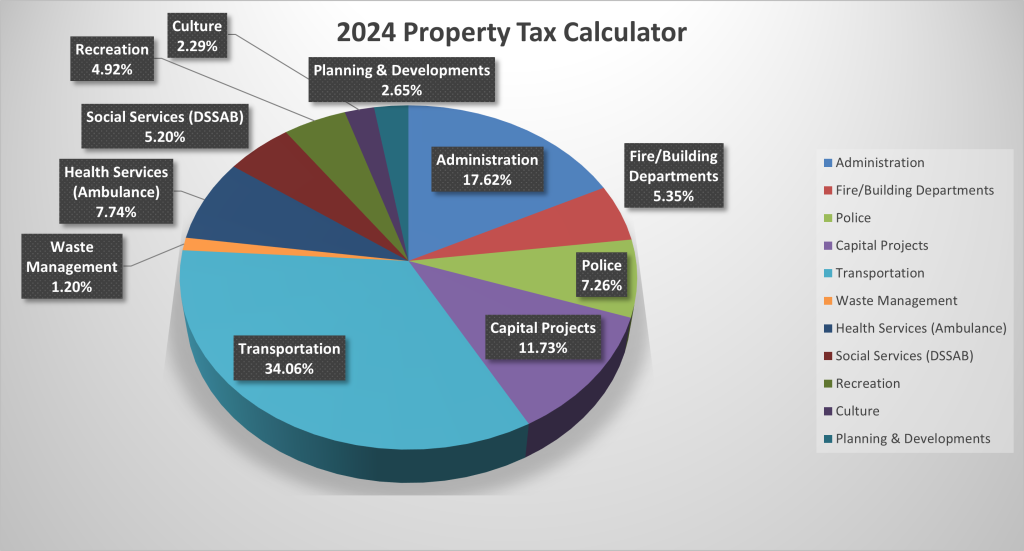

How Your Property Taxes Are Distributed

| Administration: | |

|---|---|

| Fire / Building Departments: | |

| Police: | |

| Capital Projects: | |

| Transportation: | |

| Waste Management: | |

| Health Services (Ambulance): | |

| Social Services (DSSAB): | |

| Recreation: | |

| Culture: | |

| Planning and Development: | |

| Total Levy: | |

| School Board: | |

| Total Taxes Payable: |

Payment Options

• Taxes are payable by cheque, cash, credit and interac at the Municipal Office.

• Online Banking with Bank of Montreal, Royal Bank of Canada, TD Canada Trust, and CIBC. Search “Assiginack Township” in the Bill Payment screen, your account number is the property roll number from the first zero to the last zero.

• You can pay your taxes online with a credit card using our safe and secure third party payment service by Paymentus: click here to access the payment portal.

• You can sign up for pre-authorized monthly or quarterly withdrawals from your bank account. Click here to access the Pre-Authorized Payment Form and submit a completed copy to the Municipal Office to have this set up.

Change of Address Request

If you have moved or would like your mail sent to a different address, you must provide this information to the Tax & Utility Manager in writing. You can send a letter to our mailing address: PO Box 238, Manitowaning, ON P0P 1N0 or send an email to fbond@assiginack.ca. In your request, please provide your new address and specify the tax/utility account(s) to which you would like the address changed, providing the Tax Roll/Utility Account number is the best way to do this.

Assessment Information

If you have any questions regarding your assessment on a property, contact MPAC directly. Taxpayers who feel that their assessment is inaccurate, are entitled to submit a Request for Reconsideration to MPAC by a certain date each year, depending on the property class.

Contact Information:

Municipal Property Assessment Corporation (MPAC)

P.O. Box 9808

Toronto, ON M1S 5T9

Telephone: 1-866-296-6722 (toll free)

Fax: 1-866-297-6703 (toll free)

www.mpac.ca

A formal complaint may also be filed with the Assessment Review Board (ARB). Please note, there is a fee for filing this complaint. ARB complaints may be filed over the Internet, by fax or by mail and must be filed by March 31st of the taxation year.

Contact Information:

Assessment Review Board (ARB)

655 Bay Street, Suite 1200

Toronto, ON M5G 2K4

Telephone: 1-800-263-3237 (toll free)

Fax: 1-877-849-2066 (toll free)

Email: assessment.review.board@jus.gov.on.ca

www.arb.gov.on.ca

Township of Assiginack

Township of Assiginack